This article looks at current and proposed changes to tax in the short term, that may affect you. Further announcements are due to be detailed in the Autumn Budget and Spending Review which will take place on 27 October 2021.

National insurance (NI)

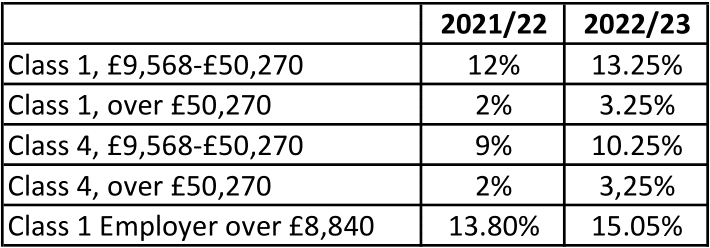

You have probably heard that the Government has announced from 6 April 2022 to 5 April 2023 there will be a temporary increase in National Insurance contributions by 1.25%.

The increase will apply to Class 1 paid by employees and Class 4 paid by self-employed, and to Class 1 paid by employers. It will not apply to those over the State Pension age, although the new levy from 2023/24 onwards will apply to earnings of those of pensionable age (but not to pension income).

Note that the above thresholds are those that currently apply in 2021/22 and may change in 2022/23.

If you pay yourself the minimum tax efficient salary each tax year (£8,840 in 2021/22), then no NI is incurred although you will qualify for a credit for NI which will help towards your state pension record. If you pay yourself more than this, then you will incur an increase in both employee and employer NI. For example, if you take a salary of £50,000 you will incur an extra £505 of employee NI and an extra £520 of employer NI.

The projected £12bn annual income from the increase is to be ringfenced to pay for health and social care.

From April 2023, NI rates will return to 2021/22 levels and a new “health and social care levy” will be introduced. This levy will be payable by employees, the self-employed and employers, as well as those of pensionable age. The levy will be shown separately on your payslip.

Dividends

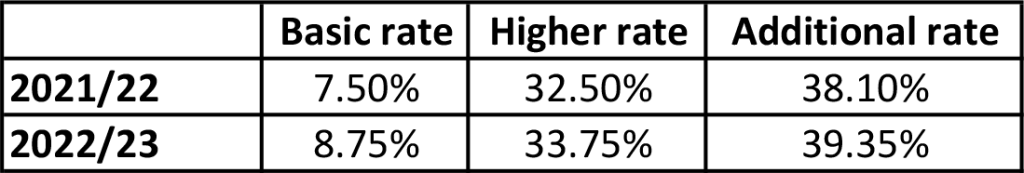

In addition to the levy, the Government has announced a 1.25% increase in dividend tax rates from 6 April 2022. The £2,000 dividend allowance is expected to remain.

The rates will change as follows:

The intention is that the additional revenue raised from this will contribute towards funding social care in the UK. Current proposals provide that anyone entering care from October 2023 onwards will receive a cap of £86,000 placed on the amount they need to pay towards their personal care throughout their lifetime.

It should be noted that the £86,000 only applies to the personal care element of residential care costs; it does not apply to the accommodation, food, and cleaning costs. Additionally, the cap only applies to eligible care needs, as assessed by your local authority, meaning that only care assessed as being necessary will count towards the £86,000. Age UK recently identified that around 23 per cent of care requests were rejected on the grounds that the applicant failed to meet the eligibility criteria.

There will also be caps based on your assets. If you have assets (savings/home) of less than £20,000 you will not make any contribution to care costs (previously £14,000). If you have assets between £20,000 and £100,000 you will be eligible for means-tested support and make only partial contributions.

VAT rate on hospitality changing 1 October 2021

The rate of VAT on food, accommodation and entry fees to attractions was lowered to 5% during the pandemic. This is now scheduled to increase to 12.5% from 1 October 2021 until 31 March 2022, after which it will return to the standard rate of 20% from 1 April 2022.

This reduced rate does not apply to sporting events, or to alcoholic drinks which continue to be standard rated at 20%.

If you are VAT registered and are reclaiming VAT on accommodation or subsistence, you will need to check the VAT receipt you receive to ensure you recover the correct amount.

VAT registered businesses and Making Tax Digital

Legislation enacting the extension of Making Tax Digital (MTD) for VAT was laid before parliament on 7 September. It is confirmed that VAT-registered businesses with a turnover less than £85,000 will be subject to the MTD VAT rules from their first VAT period starting on or after 1 April 2022. This means that all VAT registered businesses will be required to use software to submit their VAT returns from April 2022 onwards. The online portal will be closed. If this affects you, please get in touch with us as soon as possible to discuss the best course of action.

Self-assessment and Making Tax Digital – delayed start

Last week the Government announced a delay to the introduction of MTD for Income Tax. This will now commence from April 2024 instead of April 2023. To start with, it will only apply to a select number of people – landlords and sole traders who have income of more than £10,000. General partnerships will not be required to join until April 2025, while the date for other types of partnerships will be confirmed in the future. This will provide more time for businesses to prepare ahead to accommodate the changes.

One such change being proposed is to the basis periods of assessment for sole traders and partnerships, to bring them in line with the tax year. Currently businesses have the choice of preparing accounts up to any date they choose and the profits from the accounting period that ends in the tax year are used to assess tax for that year. The plan is for this to be changed so that profits are taxed in the tax year in which they arise. The ‘tax year’ can end anytime between 31 March and 5 April. Therefore, anyone using 31 March as their accounting yearend can continue to do so without any change, and profits arising in the year ending 31 March 2025 will be used for the 2024/25 tax year, with no need to apportion for the few days between 1 April – 5 April.

Any sole trader business or partnership that currently uses an accounting year end other than 31 March – 5 April will need to check the transitional arrangements, which will affect both the 2023/24 and 2024/25 tax years. Current proposals suggest that for 2023/24 the business will be taxed on the profits arising in accounting period ending in 2023/24, plus a proportion of their profits from the subsequent accounting year, which could materially affect the tax liability that arises on 31 January 2025. We will keep you updated but if you think this applies to you and wish to discuss, please get in touch.

Need more time to pay your tax?

To date, HMRC have been a bit more lenient with penalties than they usually would, particularly if you have been affected by coronavirus and could not comply with your obligations as a result. If you have been charged a penalty and feel like you have a reasonable excuse, it would be worth writing to HMRC to appeal against it (or ask us to on your behalf).

If you are struggling to find the funds to pay any tax, contact HMRC as soon as possible to arrange a plan. This may help avoid penalties being applied or interest accruing. See here for more information about Time to Pay or you can contact HMRC’s dedicated coronavirus helpline on 0800 024 1222.